The white picket fence and the isolated nuclear family unit once defined the American Dream, but the financial landscape of the 21st century is forcing a pivot toward a more ancient way of living. Today, more than 59 million Americans live in multigenerational households—defined as homes with two or more adult generations under one roof. Whether it is adult children moving back home to pay down student debt or aging parents moving in to avoid the exorbitant costs of assisted living, the financial incentives are undeniable. However, merging bank accounts, utility bills, and mortgage payments with family members requires more than just good intentions; it requires a rigorous financial strategy.

Deciding if a multi-generational home is a good financial move depends on your ability to navigate the complex intersection of family dynamics and fiscal responsibility. When you share a roof, you are essentially launching a small business where the primary product is shelter and the stakeholders are your relatives. To make this move work, you must look beyond the immediate savings and consider the long-term impact on your credit, your tax liability, and your retirement goals.

The Economic Case for Multigenerational Living

The primary driver for multigenerational living financial benefits is the massive reduction in “overhead” costs. When you consolidate two or three households into one, you eliminate redundant expenses like separate internet subscriptions, property taxes, and home maintenance contracts. According to Pew Research Center data, adults living in multigenerational households are less likely to live in poverty compared to those living in different arrangements—a testament to the protective power of shared resources.

Consider the “Sandwich Generation”—those who are simultaneously raising children and caring for aging parents. For these individuals, sharing a home with parents can slash childcare and eldercare costs, which are two of the most significant line items in a modern family budget. If a grandparent provides childcare while the parents work, the family could save upwards of $15,000 to $25,000 annually, depending on their location and the number of children. These savings can be diverted into high-yield savings accounts or 529 college savings plans, accelerating the family’s overall wealth-building journey.

“Family is the most important thing in the world, but when it comes to money, you have to treat them like a business partner. You need a written agreement, clear boundaries, and a shared vision for the future.” — Suze Orman, Personal Finance Expert

Breaking Down the Housing Costs: A Comparative View

To understand if this move makes sense for your wallet, you need to look at the numbers side-by-side. Housing costs are typically the largest expense for any American household, often consuming 30% or more of gross income. By pooling resources, you can often afford a larger, more comfortable home in a better school district or closer to urban centers than you could individually.

| Expense Category | Two Separate Households (Monthly) | One Multigenerational Household (Monthly) | Estimated Monthly Savings |

|---|---|---|---|

| Mortgage/Rent | $3,800 ($1,900 each) | $2,800 (for a larger home) | $1,000 |

| Utilities (Power/Water/Heat) | $600 ($300 each) | $450 | $150 |

| Internet & Streaming | $240 ($120 each) | $120 | $120 |

| Groceries & Household Goods | $1,200 ($600 each) | $950 (Bulk buying) | $250 |

| Total | $5,840 | $4,320 | $1,520 |

As the table illustrates, a family can potentially save over $1,500 per month by consolidating. Over a decade, that adds up to $180,000—not including the interest earned if those savings are invested in the market. This capital can serve as a powerful engine for debt repayment or as a “launchpad” for younger generations to eventually purchase their own property with a substantial down payment.

The Hidden Financial Benefits: Beyond the Mortgage

While the mortgage is the most visible saving, the secondary financial benefits are equally compelling. Sharing a home allows for “labor specialization” within the family. Perhaps one member is skilled at home repairs, while another is a savvy grocery shopper who uses coupons and meal-prepping to keep costs down. This internal economy reduces the need to hire outside help for landscaping, cleaning, or maintenance.

Furthermore, multigenerational living provides a unique form of “social insurance.” If one family member loses their job, the household is not immediately at risk of foreclosure because multiple income streams support the mortgage. This safety net reduces the stress of career transitions and allows individuals to take calculated risks, such as starting a business or pursuing further education, which can lead to higher lifetime earnings.

Tax Implications and IRS Considerations

Living together changes your relationship with the Internal Revenue Service (IRS). You must understand how these changes affect your tax return to avoid penalties or missed opportunities. One common question involves the “Head of Household” filing status. To qualify, you must pay for more than half of the household’s expenses and have a qualifying dependent living with you for more than half the year. If you are supporting an aging parent, you may be able to claim them as a dependent, provided their gross income is below the IRS threshold and you provide more than half of their financial support.

If you are the homeowner and your adult children or parents pay you “rent,” the IRS may view this as taxable income. However, if they are simply contributing their fair share of the actual household expenses (utilities, groceries, mortgage principal), it is often not considered income. You should consult a tax professional or review guidelines on the Consumer Financial Protection Bureau (CFPB) website to ensure you are documenting these transactions correctly. Keeping a “household ledger” is a practical way to prove that money moving between family members is for shared expenses rather than a commercial rental arrangement.

Legal Ownership and the “Title” Trap

One of the most significant financial risks in multigenerational living involves the title of the home. If you and your parents buy a home together, how should the deed be held? If you choose “Joint Tenancy with Right of Survivorship,” the property automatically passes to the survivor when one owner dies, avoiding probate. However, this also means that the home could be at risk if one owner faces a lawsuit or a tax lien.

Another option is “Tenants in Common,” which allows each person to own a specific percentage of the home (e.g., you own 70%, your parents own 30%). This is often better if the financial contributions are unequal. Before signing any closing documents, you should discuss these options with a real estate attorney. Protecting your equity is paramount, especially if you are investing your life savings into a property that you do not fully own on paper.

“Debt is dumb, and the borrower is slave to the lender. If you are going to live with family, make sure everyone is on the same page about the mortgage. Do not let a family disagreement turn into a foreclosure.” — Dave Ramsey, Personal Finance Author

Pitfalls to Watch For

Even the most loving families can run into financial friction when living under the same roof. To protect your financial health, you must be aware of these common pitfalls:

- The “Free Rider” Problem: This occurs when one family member stops contributing financially or through labor, putting an undue burden on others. Clear, written expectations are the only cure for this.

- Invisible Maintenance Costs: Major repairs like a new roof or a failing HVAC system can cost tens of thousands of dollars. If you haven’t established a “House Emergency Fund,” these costs can spark massive arguments about who owes what.

- Retirement Imbalance: If parents sell their primary residence to move in with children, they are often trading a liquid asset (the cash from the sale) for an illiquid one (equity in the child’s home). If the arrangement fails, the parents may lack the funds to move back out into independent living.

- Credit Score Contagion: While your credit scores remain separate, sharing a mortgage or co-signing for a renovation loan links your financial reputations. One late payment by a family member can tank everyone’s ability to borrow in the future.

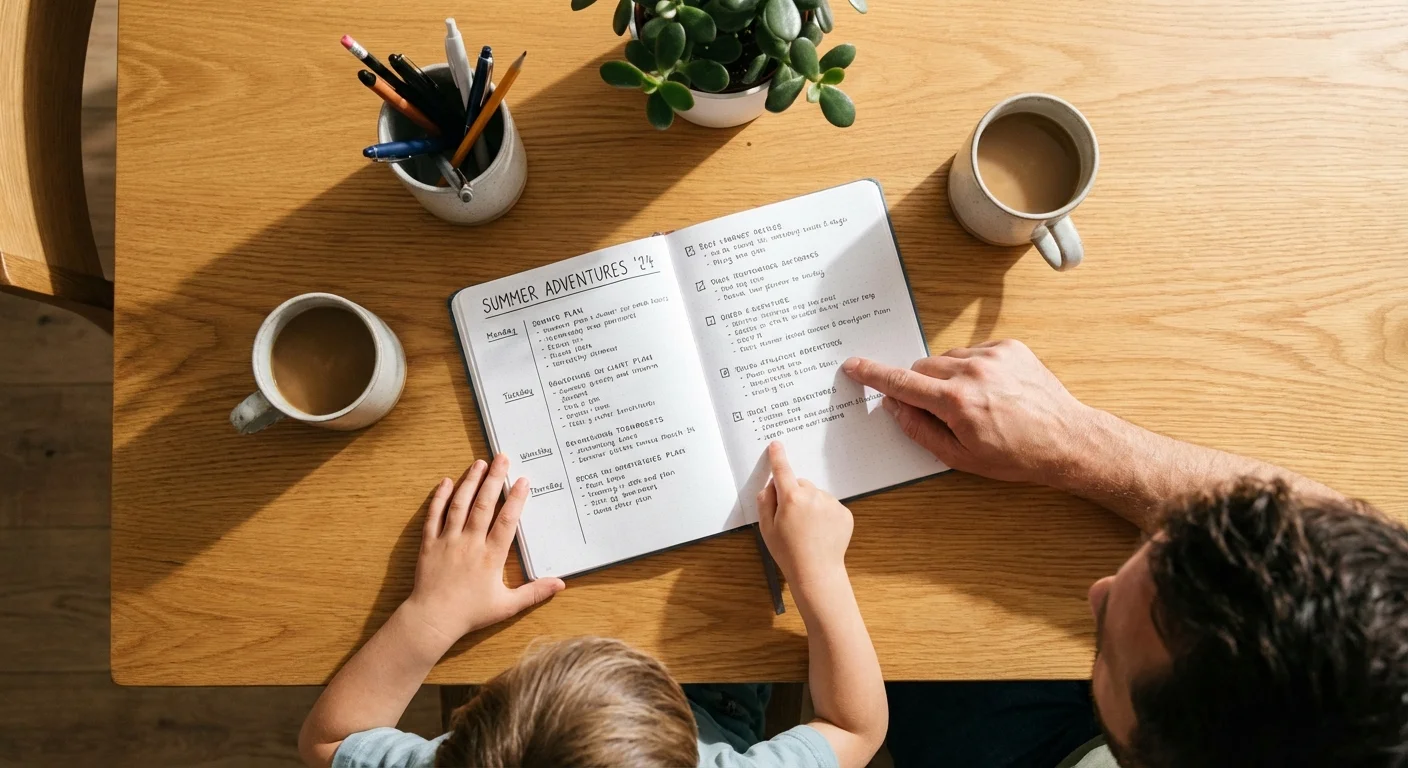

Creating a Household Financial Agreement

To treat this move like the professional arrangement it is, you should draft a “Household Financial Agreement.” This does not need to be a formal legal document, though it can be. At a minimum, it should be a written memo that everyone signs. Your agreement should cover:

- Expense Distribution: Who pays for what? Is the mortgage split 50/50, or is it proportional to income?

- The Exit Strategy: What happens if someone wants to move out? How will their equity be paid out? How much notice is required?

- Maintenance and Upgrades: If you decide to add a “mother-in-law suite,” who pays for the construction? Does that person gain more equity in the home as a result?

- Groceries and Consumables: Will there be a “house kitty” for shared goods, or will everyone buy their own?

By addressing these questions upfront, you eliminate the “assumptions” that lead to resentment. Transparency is the best tool for maintaining family harmony while sharing a bank account.

Getting Expert Help

While multigenerational living is often a DIY financial strategy, there are specific scenarios where you should seek professional guidance:

- When drafting a co-ownership agreement: If multiple parties are contributing to a down payment, a real estate attorney can help structure the deed to protect everyone’s investment.

- When an aging parent has significant medical needs: A Certified Financial Planner (CFP) can help you navigate the complexities of Medicaid and the “look-back” period, ensuring that moving in together doesn’t disqualify them from future benefits.

- When there are multiple siblings: If you are moving in with your parents but have siblings who aren’t, you need to discuss how this affects the eventual inheritance. An estate planning attorney can help prevent family feuds down the line.

- When tax filing becomes complex: If you are claiming parents or adult children as dependents, a CPA can ensure you are maximizing credits like the Credit for Other Dependents (ODC).

The Intergenerational Wealth Transfer

Beyond the monthly savings, multigenerational living is a powerful tool for building intergenerational wealth. In the United States, the majority of wealth is tied up in home equity. When a family stays together, that equity remains concentrated and grows over time. Instead of selling a home and losing 6% to realtor fees every time a generation moves, the property stays in the family, serving as a stable foundation for the next generation.

This “consolidation of capital” allows the family to make larger investments that would be impossible for an individual. For example, the combined savings from a multigenerational household could be used to purchase a second investment property, creating a new stream of passive income for the entire family. This is how “old money” families have operated for centuries—by pooling their resources to ensure the collective success of the lineage.

Is it Right for You?

Ultimately, a multigenerational home is a high-reward financial move that comes with high emotional risks. It requires a level of communication and financial transparency that many families find uncomfortable. You must be willing to discuss your income, your debts, and your spending habits with your parents or children. If you can bridge that gap, the financial rewards can be life-changing, providing a level of security and wealth-building potential that is rarely achievable on a single income.

Take the time to run the numbers, host a family meeting, and be honest about your expectations. If everyone is on board and the math adds up, moving in together could be the smartest financial decision your family ever makes. For more information on managing shared debts or understanding mortgage options, you can visit the Bankrate or Investopedia resources for detailed guides on co-borrowing and family financial planning.

This article provides general financial education and information only. Everyone’s financial situation is unique—what works for others may not work for you. For personalized advice, consider consulting a qualified financial professional such as a CFP or CPA.

Last updated: February 2026. Financial regulations and rates change frequently—verify current details with official sources.

Leave a Reply